Whether you’re an accountant or a client, health concerns related to the COVID-19 pandemic has made it difficult to send and receive confidential tax and other financial information. Documents that may normally be dropped off at the accounting office, now have to be sent through digital methods such as email and personal drop boxes, or through courier.

Regardless of the method you use to share information, privacy must always be your #1 concern, especially since financial records contain information that could be used for identity theft or other malicious activities if it landed in the wrong hands.

Below, we offer 3 different ways you can send tax documents securely in the 2022 Tax Season.

1. Ship encrypted flash drives

If you still prefer to use courier, it’s better to send a your documents on an encrypted flash drive instead. By encrypting a flash drive, even if your package goes missing, unlike loose documents, it would be difficult for anyone to access your documents from a flash drive that’s password protected if they do not know the password.

Norton™ has a great article on how to encrypt a flash drive.

2. Email password-protected documents

Emails are generally not encrypted which means that after you click the “send” button, there is a chance that an email can get intercepted by an unauthorized third party or individual. If that happens, they’ll have access to any confidential information that was being shared.

Just to be safe, you should always password-protect your documents before you uploading them as an attachment.

There are a couple of common ways you can password protect documents:

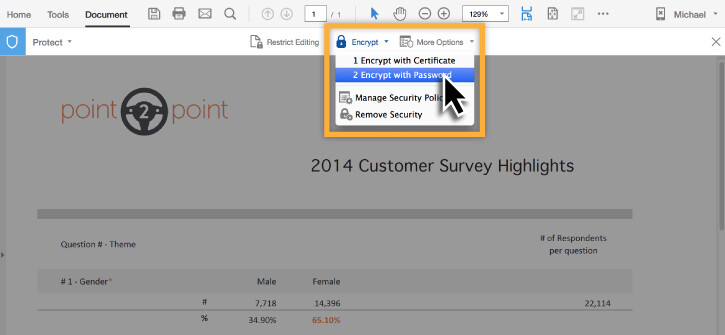

1. Use Adobe Acrobat DC

Adobe Acrobat allows you to encrypt documents with a password before sharing them. Recipients will only be able to open the document if they enter the correct password.

Follow Adobe’s Tutorial to learn how to send PDF documents securely.

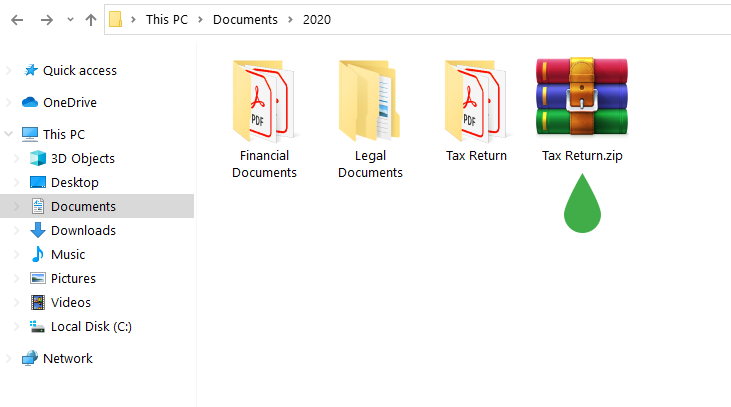

2. Create a password-protected zip file

Aside from keeping your documents secure, zip files will reduce the overall package size of your documents, potentially enabling you to send more attachments in a single email. Like password-protected PDFs, recipients will also need to enter the correct password to open the zip file.

Creating password-protected zip files are easy if you have software like WinRar installed. Check out our tutorial on how to encrypt zip files before emailing them.

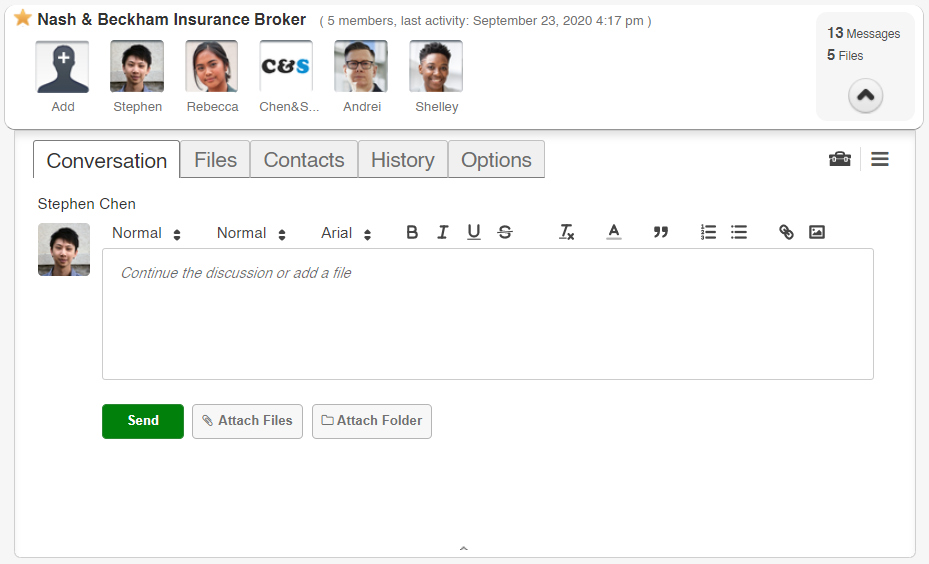

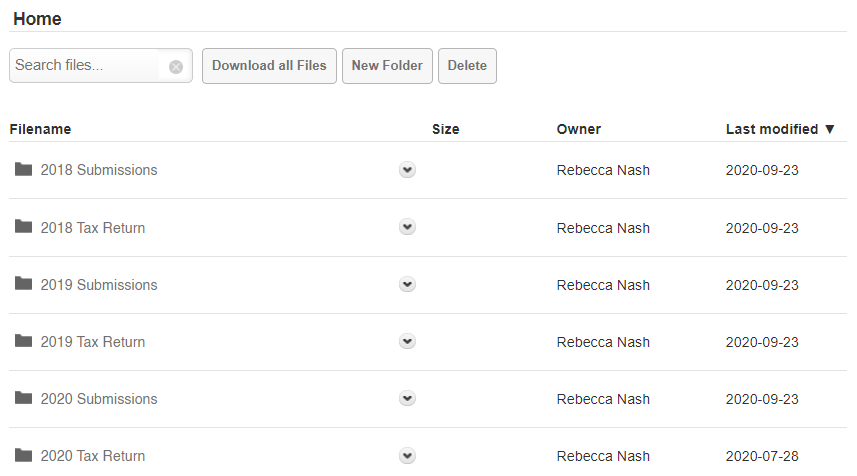

3. Send documents through TitanFile

If you need to send documents frequently, it’s not practical to send every package through courier or password protect them before emailing them. That would take up a lot of your time!

Instead, you can use TitanFile. It’s the easiest way to send tax documents and messages securely during tax season.

When you send documents through TitanFile, they’re automatically encrypted so you won’t have to worry about privacy when you’re sharing anything confidential. Simply upload your attachments, and click send.

In addition, TitanFile keeps all of your documents messages neatly organized in a single platform so you don’t have to rely on email and several other file-sharing solutions.

TitanFile is currently offering a free Secure Client Portal program for accountants which provides free access to the TitanFile platform until April 30th, 2022. If you’re an accountant, you can sign up for the program here: https://www.titanfile.com/2022-secure-client-portal-program/

If you’re a client, you can recommend this program to your accountant to help keep your own tax documents secure.