Tax season, a.k.a busy season for accountants, is quickly approaching! Every year, Canadians must file their taxes based on their reported annual income in order to calculate their tax liability, schedule payments, or request refunds for overpayment. Failure to comply can result in penalties of 5% interest on the balance owing, plus an additional 1% monthly interest for up to 12 months. In severe cases, tax evaders can face prison time. So how should you send your tax returns? Is email safe enough?

Is it Safe to Email Tax Returns?

In short, the answer is no. If you’re in a time crunch and can’t read the whole five-minute article, you can feel confident knowing email will not safely deliver your tax returns this tax season. If you’ve got time, stick around and find out what makes email non-secure and the best alternatives for sending tax returns.

Why Is Email Not Secure?

Email has been one of the most commonly used methods for sharing documents online since the 1970s. At the time, it was the first of its kind to foster nearly instantaneous communication online which immediately proved beneficial to companies and individuals who needed to share information fast. However, as technology has advanced throughout the years, webmail services, such as Outlook and Gmail, have not kept up with the security requirements needed in the current digital climate.

There are two main components that make email non-secure:

1. Emails Cross Multiple Networks

Once you hit ‘send’ your email traverses the internet to your recipient’s computer and crosses multiple networks in order to reach the final destination. However, you will never know how many networks or servers your message will pass through and there is no guarantee that these networks are secure. Man-in-the-middle attacks are a very common network cybersecurity threat – hackers enter access points via servers along the email journey and intercept them to steal your information.

2. Email Is Unencrypted

If you’re not familiar with encryption, we’ve got a quick read on it. In a nutshell, encryption ensures that your confidential information is protected throughout the entire file-sharing journey by converting plain text into ciphertext (coded). Your data becomes unreadable to everyone except the intended recipient. Even if an unauthorized third party were to intercept your email, the information itself is invaluable because it appears as randomized letters and numbers.

Unfortunately, email is not encrypted. In the event that your email was intercepted by a cyberattacker, it can be read, shared, and exploited to the hacker’s heart’s content.

Email Alternative

There are many risks of sending sensitive information via email. That’s why people traditionally send tax return by mail. However, much like other outdated file-sharing methods (i.e. USB, FTP), it poses a threat to sensitive information. Tax returns can get lost or stolen, and it’s definitely not the type of information you want in the wrong hands. Luckily, there are some easy and safe ways to send your tax documents this 2023 tax season.

Use a Secure File Sharing Software

Email was not developed to be secure, but TitanFile was. TitanFile is an award-winning secure file-sharing and collaboration solution that is as easy to use as email. Simply, add your contact, upload your document, and hit send! Accountants and Auditors in Canada, the U.S., and the EU use TitanFile to communicate with their clients and send and receive tax documents safely. Tax documents uploaded to TitanFile are automatically encrypted in transit, at rest, and end-to-end to protect data every step of the way. It’s the easiest (and safest) method for sending tax returns this year!

TitanFile has a 15-day free trial (no credit card required).

How to Send Tax Documents Securely via Email

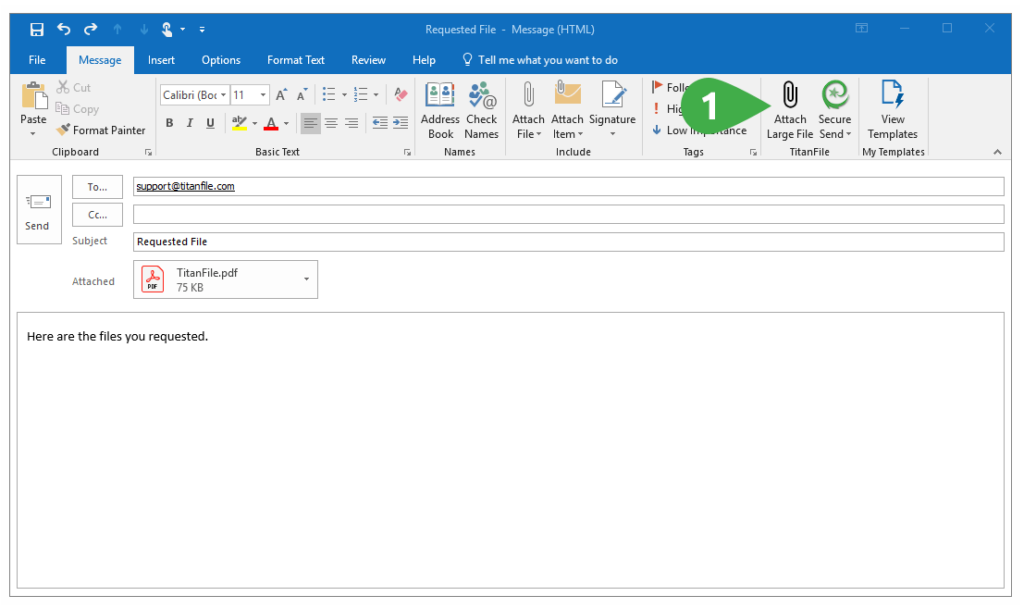

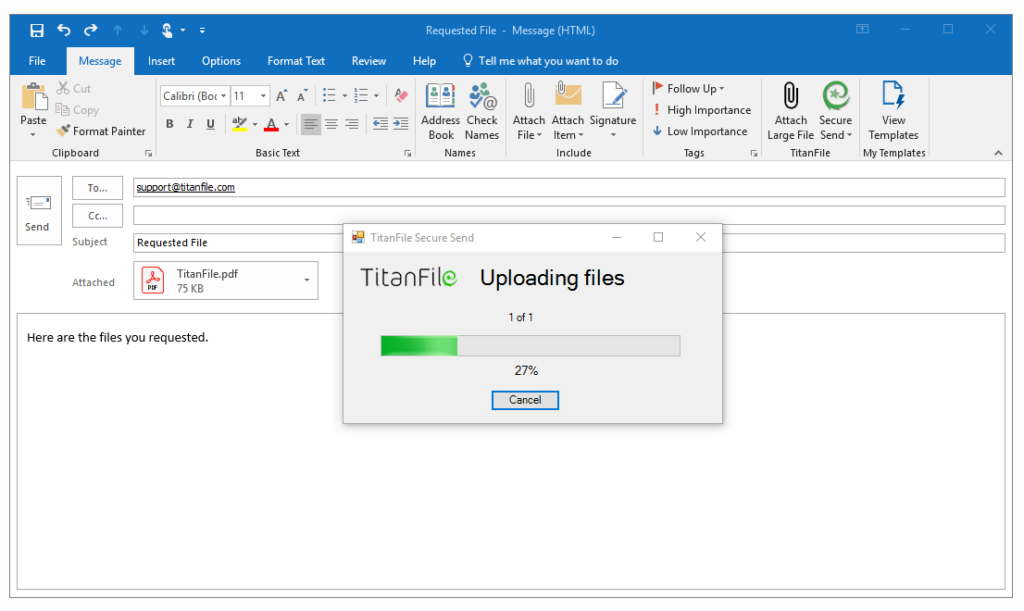

It’s difficult to make a change, especially when a stranger on the internet tells you to do it. Email is a classic file-sharing method and although it’s not secure, we can all agree it’s very easy to use. If you would like to continue using email to send tax returns, we recommend using TitanFile’s Outlook plug-in – which automatically encrypts documents sent via Outlook to ensure confidential information is protected.

Here’s how to send your tax return via Outlook:

1. Sign up for a free trial of TitanFile.

2. Download the Secure Send add-in here and follow the installation instructions. After installing the add-in, you’ll see two new icons labelled “Attach Large File” and “Secure Send” on Outlook’s navigation ribbon.

3. Add a contact, subject line, and message like you normally would with Outlook.

4. Upload your files and click “Secure Send” to send your encrypted tax return!

Just like that, you’ve sent your tax return via email in a secure and easy way. We hope this article helped make this tax season a little bit less stressful for you!